If you need to return financed car because you can’t make your payments anymore, you’re not alone. Whether due to illness, job loss, or unforeseen circumstances. No fewer than 1.3 million Americans annually have found themselves facing repossession of their vehicle since 2012. When considering the best of a bad set of options, there is an alternative way to voluntarily surrender a financed or leased car without being forceful or embarrassing. Please fill out the form below and a representative will contact you. This would take only 1 to 2 business days to assist you with the process.

Return Financed Car Today

Southern Title Liens can assist you with voluntarily surrendering a vehicle you can no longer afford. We have experience working with towing companies and lien-holders on a regular basis. Our selected towing and storage companies can remove financed car and store in a secure lot at no cost to the vehicle owner who wants to return the financed car.

How To Voluntarily Surrender A Vehicle On Your Time

You can voluntarily surrender a vehicle by authorizing our Towing & Storage company to remove it from your property. Once completed, the Towing Company is required to notify the lien-holder for you within 7 days. The lien-holder pays the towing and storage charges within 7 – 50 days to repo your vehicle.

This Type Of Voluntary Surrender Is Less Hassel

If the payments stop and you disappear on the lender, the lender will assume you intend to keep the car as long as possible. At some point, the lender will engage a repossession agent to reclaim the car. He or she may follow you or use your car’s GPS locator to find the vehicle.

The “repo man” will show up at your home or workplace or while you are running errands to secure the vehicle. This could embarrass you in front of friends or colleagues and leave you stranded, unable to get home or pick up the kids. Living with this kind of uncertainty induces stress, which is harmful to your long-term health. Requesting it to be removed yourself, may allow you to breathe easier. Plus, If the lien-holder doesn’t claim or pay the towing and storage charges, the vehicle gets sold at auction and title transferred out of your name within 2-3 business days. What happens to the vehicle after that point is no longer your responsibility.

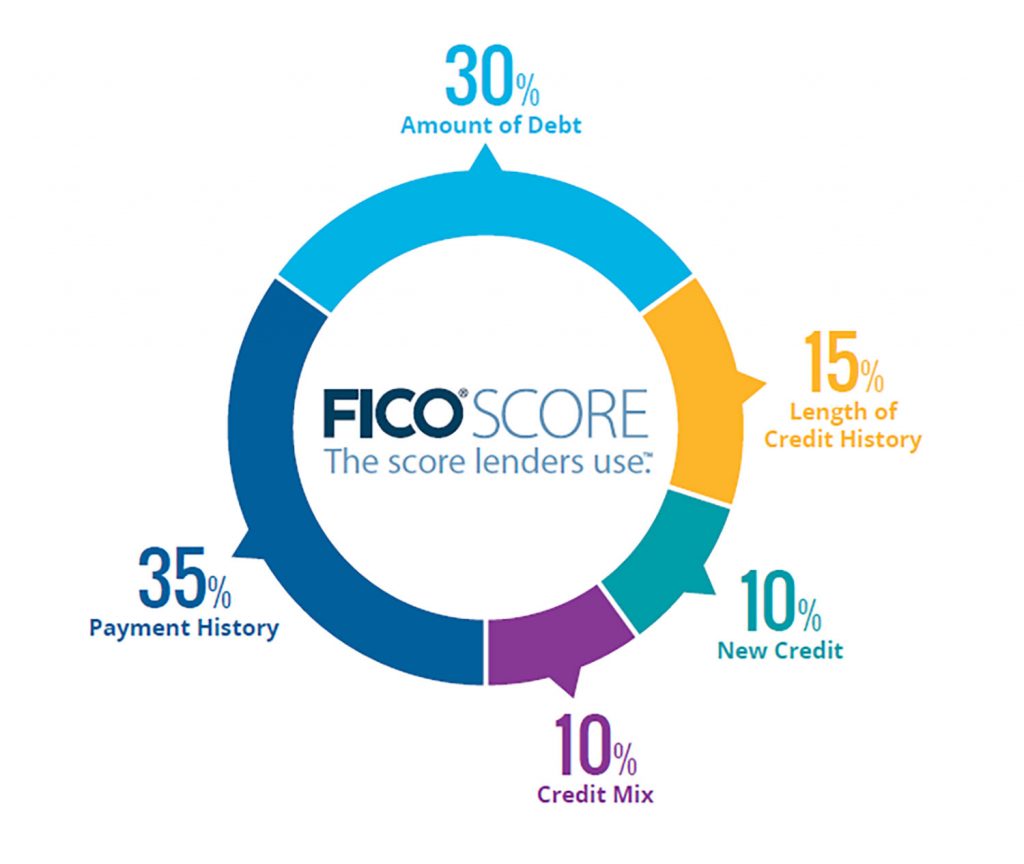

Impact On Credit Scores

Your credit scores are meant to predict your ability to make loan payments in the future. A past history of nonpayment is considered a key risk factor in future defaults. It affects your ability to borrow in the future or even qualify for jobs or home leases. If and when the lender reports the repossession to the credit bureaus, your score will absolutely go down. The defaulted loan will stay on your credit for seven years, after which by law it must be removed. Remember that after seven years you may have to request that the credit bureaus remove the notation of the repossession, so mark your calendar.

The problem is not whether the return of the financed car is voluntary or involuntary, nonpayment is still nonpayment. Your FICO score, the grade from 550 to 850 that most lenders use, is calculated by a computer based on the number of missed payments. Therefore, a voluntary repossession is likely to reduce your score just as much as an involuntary repo.

If You Try To Sell The Vehicle Instead

Some borrowers facing repossession might consider selling the car themselves to pay off the loan, perhaps to get a better price and avoid owing the bank. The problem with this strategy is that the car might take a long time to sell and you might not get the price you anticipate. If you sell the car for less than the balance owed, you could potentially use your own cash to pay off the difference … but borrowers with that kind of cash reserves usually prefer to keep making payments and keep the car.

If you do try to sell the car for less than the balance owed, problems will arise. The legal instrument by which a piece of property becomes security for a loan is called a “lien”. In Florida, the DMV holds the title electronically until you make a settlement with the lien-holder. Furthermore, selling a vehicle without a title that has a lien filed against it, could get you into deep trouble.

This is why potential buyers often ask if you have a “clean title”. They don’t want some lender attempting to repossess their newly-purchased car, while the seller makes off with the sales proceeds. Essentially, it is a very bad idea and possibly a felony if you sell a car and don’t intend to pay the lender enough money to settle the lien for their collateral.